The Omnipotence of Organization – Tidy Your Way to the Top!

News flash! Getting organized has major benefits that go way beyond the basic advantages you’d expect.

Basic advantages like actually knowing where things are, for instance, so you don’t waste valuable time rifling through drawers, purses, and overflowing file folders to lay hands on pertinent paperwork. Studies show that keeping your environment organized can play a major role in everything from alleviating stress and raising morale to increasing productivity and enhancing your concentration. Reduced Stress can help to improve your sleep patterns, mitigating your risk of a heart attack, as well as helping you to eat better and lose weight!

So, it’s clear that, at the very least, becoming more organized can have a positive impact on your financial recording and reporting. Just imagine, no more missed filing dates and subsequent late penalties. No more threatening letters from the CRA with demands for your year-end or taxation information when the sad truth is that you don’t have a clue as to the whereabouts of last year’s receipts!

Sure, you’ve got a good excuse; you’re too busy growing your business. There’s no time for organizing paperwork when you’re focused on client attraction and bettering your bottom line. That’s all well and good, but when your request for a loan is denied, thereby sidelining your office expansion plans, you’re going to wish you had spent more time and effort supporting your financial viability with appropriate proof.

Don’t despair! At Preferred Client Services, our team of full-cycle bookkeeping experts has seen the very worst and helped them get organized. There’s hope for you yet. All it takes is a wise investment in time management to remedy your day-to-day paperwork disasters, a little injection of good old-fashioned advice, “a place for everything and everything in its place”.

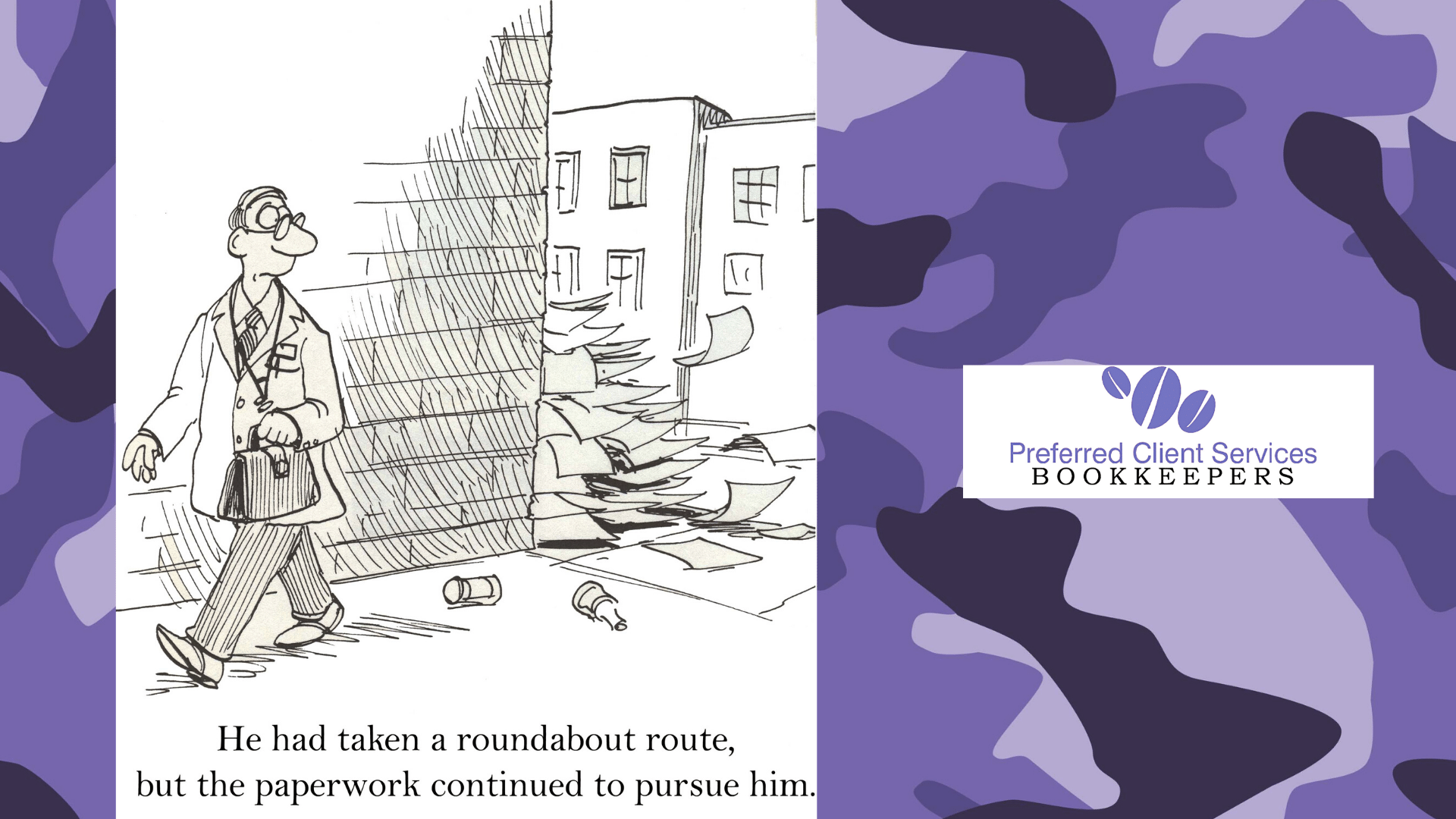

No matter the size or nature of their operations, all business owners face certain challenges. They may experience anxiety and feel overwhelmed. In other words, you’re not alone, so stop feeling inadequate and let’s get organized! Why wait until skyscrapers of papers are leaning precariously over the edge of your desk? Planning an extra half hour into every day to promptly enter incoming transactions and file your paperwork will save you entire weekends of playing catch up. You can avoid those inevitable time crunches and spend quality time with your friends and family, or furthering your business goals.

Your goal is to clean up your current mess and put systems in place to make sure it doesn’t degenerate to this sorry state of affairs again.

Take it one step at a time and arrange all your accounts payable and receivable invoices in chronological order month by month, paid and outstanding. Verify if any sales still need to be invoiced or if any client invoices are awaiting payment. Set up a concrete, consistent plan to collect your receivables and pay your outstanding bills. Ensure your data is accurate and classified correctly by reconciling your banks, credit cards, loans, and lines of credit. Then, print out all credit card and bank statements for your files.

Barb Steckly, our founder and CEO here at Preferred Client Services, recommends the 10th and 25th Strategy for bill paying. On those two dates every month, devote the time to prepare your accounts payable paperwork. Even if you’re not quite ready for payment to go through, you can schedule it for later, but, at least, the bulk of the accounting effort has been completed. By the 10th of the month, you’ve likely received everything in from the previous payment period, and, by the 25th, for the most part, the current month’s invoices are in as well. These two dates are specifically chosen to ensure you have plenty of time before payment deadlines and, therefore, less chance of being late.

See, you’re on your way! Doesn’t that feel better? Why not capitalize on your progress by establishing some easy record-keeping procedures you can follow moving forward? We suggest that you keep receipts for everything business-related. Your office supplies, gas expenses, and meals with clients are just a few examples. Always write the name of the client on your bill before you store it in the file folder for that month. When your credit card statement arrives, simply match the receipts to the statement and staple them together. Come tax time you’ll be reaping the benefits of your due diligence when your bookkeeping expenses are cut in half!

File customer invoices, even the voided ones, in sequential order by their designated number. To save time when looking for information, file your vendor invoices by the vendor’s name and keep them in alphabetical order.

Regularly evaluate the effectiveness of your system over time and make the necessary adjustments. Avoid the irritation of late payment fees and unnecessary interest by keeping track of important due dates in a daily planner. Interestingly enough, it’s been proven that having to physically write down a date helps you remember it.

Once you’ve got all the keys to bookkeeping organization in place, the trick is to commit to consistency!

Honour the omnipotence of organization! As Mikael Cho notes on Lifehacker.com, "Whether it be office desk or your closet, excess things in your surroundings can have a negative impact on your ability to focus and process information. That’s exactly what neuroscientists at Princeton University found when they looked at people’s task performance in an organized versus disorganized environment. The results of the study showed that physical clutter in your surroundings competes for your attention, resulting in decreased performance and increased stress."

Any nagging evidence of work left undone preys on your mind, and can adversely affect your mood, your concentration, and thereby sabotages your productivity. So, yes, it may take you a few extra hours a week to do your financial recording immediately instead of letting an entire pulp mill of paperwork pile up around your office, but, in the end, it will save you time and money!